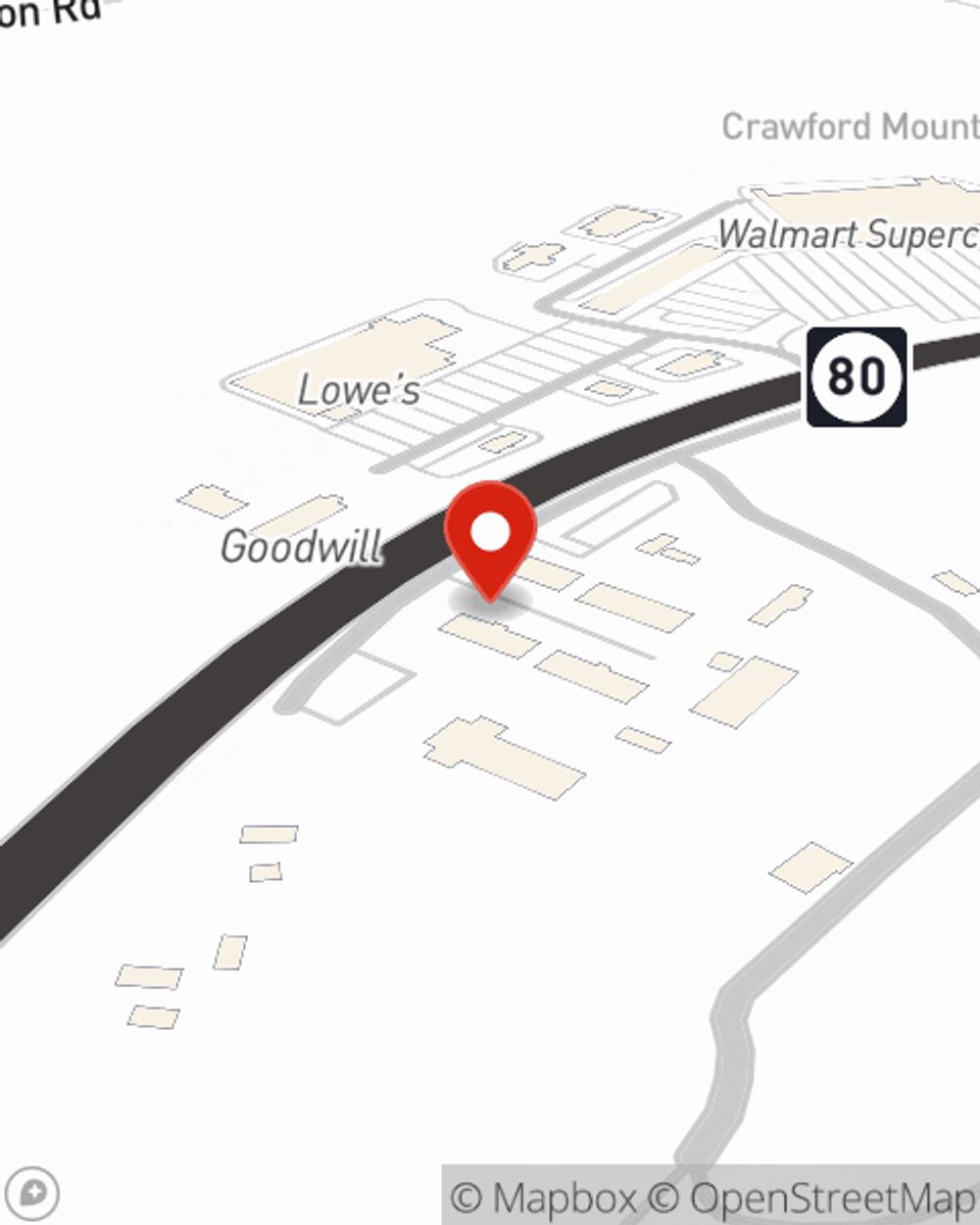

Business Insurance in and around Hazard

Hazard! Look no further for small business insurance.

This small business insurance is not risky

- Hazard

- Hyden

- Hindman

- Whitesburg

- Jackson

- Manchester

- Salyersville

- Campton

- Jenkins

- Buckhorn

- Vicco

- Viper

- Booneville

- Beattyville

- Perry County

- Knott County

- Breathitt County

- Leslie County

- Letcher County

- Clay County

- Owsley County

- Magoffin County

Help Prepare Your Business For The Unexpected.

Running a small business comes with a unique set of wins and losses. You shouldn't have to wrestle with those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including worker's compensation for your employees, a surety or fidelity bond and errors and omissions liability, among others.

Hazard! Look no further for small business insurance.

This small business insurance is not risky

Surprisingly Great Insurance

When you've put so much personal interest in a small business like yours, whether it's an ice cream shop, a HVAC company, or a home cleaning service, having the right protection for you is important. As a business owner, as well, State Farm agent Laura Feltner understands and is happy to offer personalized insurance options to fit your business.

Agent Laura Feltner is here to review your business insurance options with you. Call or email Laura Feltner today!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Laura Feltner

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.